Bay Area Luxury Home Sales Hit Record High - July 31, 2014

A new report this week confirmed

what we all suspected in the local real estate industry: The Bay Area's luxury

housing market is red hot.

Million-dollar home sales last

quarter set a new record with 5,734 luxury homes selling during the April

through June period, up from its previous high water mark of 5,699 in the

second quarter of 2005, according to DataQuick, the La Jolla-based research

firm. Statewide, there were more million-dollar sales last quarter than any

period since the peak of the market in 2007.

Led by Hillsborough, the Bay Area

boasted eight of the top 12 cities in California when it came to million-dollar

home sales. Hillsborough recorded 144 luxury sales during the quarter, second

only to Manhattan Beach with the highest price sale going for $12.9 million.

Other local cities at the top of

the luxury list included San Jose, Cupertino, Fremont, Mill Valley, Danville,

Menlo Park and Saratoga – all with more than 100 sales over $1 million during the

second quarter of 2014.

Increased demand and steep

appreciation in prices over the past year or two have driven up the number of

luxury home sales, according to DataQuick analysts. Strong gains in the stock

market and the booming tech sector probably haven't hurt, either.

As our own Wendy McPherson,

manager of the Menlo Park office, told the San Jose Mercury, home prices have

been boosted "by the amount of money being pumped out by Silicon Valley

and the international market, especially the offshore Asian buyer."

The real estate market is still

ruled by the law of supply and demand. And as long as there are so many

well-heeled buyers in Silicon Valley, San Francisco and from overseas chasing a

very limited inventory of homes on the market, the Bay Area's luxury segment

should continue to perform well.

Below is a market-by-market report from our local offices:

North Bay – There has been

a steady flow of sales the past few weeks in Novato and some increase in

listing activity, although still limited. Listings over $600k are sitting on

the market longer as we move into August's slower period. The best listings at

all price points are moving if priced well. In the San Rafael area, market

activity is slower than previous weeks. Many people are on vacation and school

starts in a few weeks. Listing inventory has slowed a bit. Our Sebastopol

manager says that it is Sonoma County Fair time, which always diminishes the

number of attendees at open houses. Most of the opens homes this year have

attracted double digit attendance. Nobody reported more than 5 attendees at

this week’s open houses. We are seeing not only an increase in listings but

also a willingness of sellers to entertain contingency offers. Previews

properties continue to sell, especially after a price reduction or two. Our

local office closed 4 sides this week and put 2 more into contract. Our Southern

Marin office closed two properties for over $3 million this week. The luxury

“Previews” market remains very strong for the most desirable properties. The

overall market has hit the summer lull with vacations and families getting

settled in for the new school year.

San Francisco – This is

an unusually "typical" summer market, says our Lakeside office

manager. The combination of agents on vacation, buyers on vacation, and kids on

vacation sapping up energy of buyers who are not on vacation has slowed traffic

at open houses and, though properties are continuing to sell at a good pace,

the tempo is less frenetic that the spring. There are some great opportunities

right now to purchase without multiple offers. Our Lombard office manager

reports that lately just perfect properties priced right or total fixers

(either end of the spectrum) are the only ones bringing large number of offers

and way over. More of the market has cooled: whether summer slow-down, agent

vacation, buyer frenzy-fatigue or any combination, hard to say. After a slight

increase in overall inventory, this week brought a reduction in both homes and

condos. Our Market Street office manager concurred that the SF market still

seems to be in its usual summer doldrums. And while the sellers putting their

properties on the market continue to be rewarded with strong prices, the number

of multiple offer situations has definitely cooled a bit. More than half the

offers ratified during this period were the result of a single offer, giving

buyers an opportunity to prevail without having to compete against one another.

But as we approach the end of July, activities appeared to be picking up a

little, our Sunset manager says. Open houses are still very well attended. The

number of multiple offers is decreasing and amount being offer is not as high as

several months ago.

SF Peninsula – Our Burlingame manager says we seem to have picked up in activity

this past week. More buyers are at our open houses and the number of sales has increased.

There have also been some very attractive listings in Burlingame, as many as 13

new properties in one week. That’s something we haven’t seen in a long time. Is

this a trend for the fall? Time will tell. Hillsborough currently has 44 active and 16 pending

listings. This is a pretty low inventory level and is probably reflective of

summer vacations wrapping up and families getting the kids ready to start

school in mid- August. What happens after Labor Day with new listings will

determine the fall market. Our Burlingame North manager adds that according to

MLS in two popular locations, the average sales price has increased in

Burlingame from $1,654,333 in 2013 to $1,818,286 in 2014Q2. The average sales

price has increased in San Carlos from $1,260,076 in 2013 to $1,515,010 in

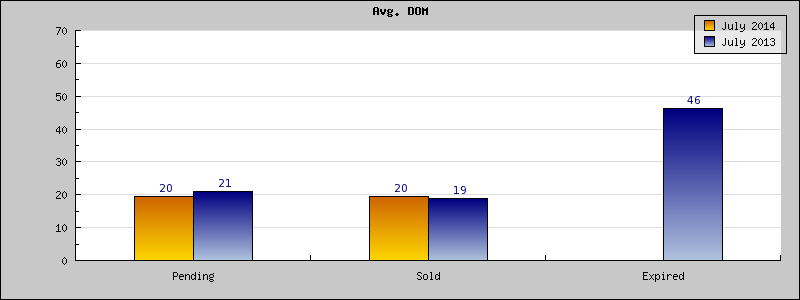

2014Q2. Average days on market have decreased in Burlingame from 25 days in

2013 to 17 days in 2014Q2 and in San Carlos from 17 days in 2013 to 12 days in

2014Q2. The Half Moon Bay market is steady. Inventory is still low. If prices are

right, homes are selling quickly with multiple offers. Open houses are very

active and many potential buyers are from out of town throughout Northern

California, Southern California, and out of state. Our Menlo Park manager

reports open houses and sales are all in slow motion compared to a few months

back. Yet 75% of the deals this last week were multiples – even one over $3.5

mil. Number of overbids is also less than a few months ago too but speaks to

vacation time for buyers. She expects a fairly robust fall. One agent just sold

5 homes to an Asian buyer in one week – between $1 million and $2 million. Inventory

remains low in Palo Alto. Demand is high and multiple offers continue. Still

almost all multiple offers in the Redwood City-San Carlos area, but the number

of offers is down. Single-family homes, particularly in San Carlos, are selling

well over the list price. The open houses, as few as there are, are still

heavily attended. Some buyers are thinking they will “just wait it out,"

but when buyers of get the home they are elated. Our Woodside-Portola Valley

manager reports that there have been a couple of over $5 million sales this

week that have been on the market for a while. Two big sales went to Asian

buyers, which she says we're seeing more of these days.

East Bay – The market under $1

million is very active, our Berkeley manager reports. There are 30-100 buyers

through open houses every week. One property received 22 offers and went 21%

over asking. Another property received 3 offers and went 22% over asking – both

houses in the $750k-800k list price range. Buyers are very unpredictable and

are feeling exhausted. All cash is not good enough, she says; no contingency

offers are getting the house. Most Previews luxury properties are still

receiving multiple offers and are selling for 10-25% over asking. In Danville

area, more homes are selling with contracts contingent on the sale of another

house. That’s a good trend for buyers, according to our local manager. In the

Oakland-Piedmont area, the number of listings available on the broker’s tour

this week is smaller than it has been the last few months, so it looks like it

is slowing up in August just like it did last year. Having said that the number

of buyers at open homes has not gone down. In fact the ratio of disclosure

packets handed out to the number of offers received has ticked up (most likely

due to the lessening number of available properties). We were seeing that about

30% of the # of listing packets out would result in offers but over the last

couple of weeks it has risen to 40 – 45% ratio. Properties, with few exceptions

are going a considerable amount over asking. The Lamorinda market has been

steady. In the Walnut Creek area, an attractive listing that is staged and

priced right may get a couple of offers. Otherwise most listings are overpriced

and agents see more and more price reductions. Buyers are out there looking and

not feeling that sense of urgency. Definitely feeling the summertime slump, our

local manager notes.

Silicon Valley – In

Cupertino, our local manager reports that things seemed a bit quieter recently,

but activity has picked up again this week. The number of offers in a multiple

offer situation has definitely diminished, but prices are getting bid up almost

as much as ever. Townhouses in the $800K+ range are particularly hot right now.

Lack of inventory continues to drive the Los Gatos area market as buyers

continue to gobble up new listings. Inventory is down in the San Jose Almaden

area from 2 weeks ago but up in Blossom Valley and Santa Teresa. Agents are still

seeing multiple offers but mainly in Almaden and Cambrian. The local Willow

Glen market is currently best described as steady. Inventory is not growing,

just staying at a steady level. Sales are just steady. Most homes are staying

on the market for longer periods of time. Most are not getting multiple offers

and most are not getting asking price; agents are seeing slightly under asking

price offers. Often agents are setting an offer review date with no offers

being submitted on that date. The under-$3 million market in Saratoga is a

sellers market. Over $3 million it needs to be special or perceived as a good

value or it is a buyers market. Multiple offers still the norm for properties

with the desirable schools. Most sellers subscribe to the marketing idea of

under pricing the home and allow it to be bid up. Those who do not subscribe to

this "eBay" method find their homes sitting on the market and needing

to do a price reduction to garner an offer.

South County – The South County Real Estate market continues to offer potential

buyers more choices than in many other areas, our local manager believes. The

diversity of the types of properties available coupled with a wide spectrum of

price ranges makes the South County a good place for buyers to find their

perfect home. Listing inventory has grown over the last several months and

between Gilroy and Morgan Hill there are over 250 homes currently listed for

sale. Offerings include homes on acreage with beautiful horse facilities to

moderately priced townhomes and condos. Homes in South County can certainly

meet buyer demand, no matter what type of home a buyer is looking for. New

developments are also adding to the mix with prices ranging from over

$1,000,000 to single family homes listed for about $500,000. There is a myriad

of choices, which makes this area so attractive to potential buyers.

Santa Cruz County – The luxury market in the San Cruz area is showing signs of being quite

healthy with sales remaining steady. In the overall market, the demand is

keeping pace with the supply as we have seen just a very small increase in

inventory for single-family homes. Prices continue to go up at what seems to be

a healthy rate, with a significant amount of 'move up buyers' taking advantage

of a healthy market and great interest rates.

Monterey

Peninsula – Agents are preparing for “Car Week” with

ads and open houses for the area's biggest week of the year, August 12-17th.

The week will bring some of the wealthiest individuals in the world to this

area to partake in the car events and shop for real estate while they are here.

The Previews market has been a little slow as of late but it seems to be the

calm before the storm. There have been reports of the international buyers

looking at properties in Pebble Beach. Compared to Bay area prices, this market

is still a relative bargain when it comes to an estate home in Pebble Beach or

a beach cottage in Carmel. Now is the time to buy before the market really

heats up with oversees money, our local manager says. The mid-level market

around the $900,000-$1,500,000 million price point is getting a lot of

attention with move up buyers and people new to the area. Floor calls and walk

in traffic seems to be steady, in fact last Friday an agent who was on floor

duty covering for somebody else received a call for an agent to come out to

list their house. She happily prepared the listing docs and was at the home at

4:30 and walked out with a $3 million new listing. That’s the excitement of

real estate, you never know when an opportunity will arise!